Accounting and Bookkeeping Services for Child Care USA 2023

To tie all the above points into one, a childcare accounting software makes financial management easier for business owners. When you need to upgrade your childcare accounting, software is a great option. Setting up healthy accounting habits when you’re starting a childcare business sets you up for success in the future. When you accurately project your finances from the beginning, you’ll also be able to save money for taxes and not face a surprise when it’s time to file. We offer a range of options from bookkeeping help using popular accounting software to tax planning and consulting services. To learn more about how we can help with your daycare’s accounting needs, schedule a consultation now.

ATS Accounting & Tax Edmonton keeps up to date with the latest developments in accounting technology and solutions to ensure financial savings for our clients. Accountant websites designed by Build Your Firm, providers of CPA and accounting marketing services. © Accountant websites designed by Build Your Firm, providers of CPA and accounting marketing services. These systems are critical because first and foremost, they let you know where your money is, where it’s going, and how much you’re making.

This way the preschool owners can have their peace of mind and not fret about falling behind on receiving payments. Illumine’s child care payment software automatically records every transaction being made. It notifies the finance department admin of the daycare payment log report while also sending the parents their payment receipts online in a PDF format.

Record Attendance & Meal Counts

Now let’s look at revenues, for example, when a child is in your care for a week, and you say to the parent, they owe you $300, under the accrual method, that would be considered income at that time. Under the cash method, it wouldn’t be considered income until the parent gave you the check and you deposited it. This method is more comfortable because it will match in many ways, the act of balancing your check book, just in a bigger sense, and in a bigger way.

Mayfield Childcare confirms investigation into alleged accounting … — The Sector

Mayfield Childcare confirms investigation into alleged accounting ….

Posted: Tue, 28 Feb 2023 08:00:00 GMT [source]

This information will help stakeholders gain a better understanding of the market and make informed decisions. Prime your billing processes for remarkable ease with our intuitive child care billing software and speedy back-office automation. You can quickly and easily enter expenses, mileage, hours and care so that you can claim them as business expenses. The program can also calculate the time/space % for your home, so that you can claim the parts of your home that you use for your business (play area, office area, kitchen, etc.) on your taxes.

Providing our neighbors with a job well done is why we get up in the morning. When you’re looking for bookkeeping and QuickBooks training nearby, Better Bookkeepers is the best choice. In addition to the scope of our services and the tailored approach we take to bookkeeping, there are several other factors that make us the right choice.

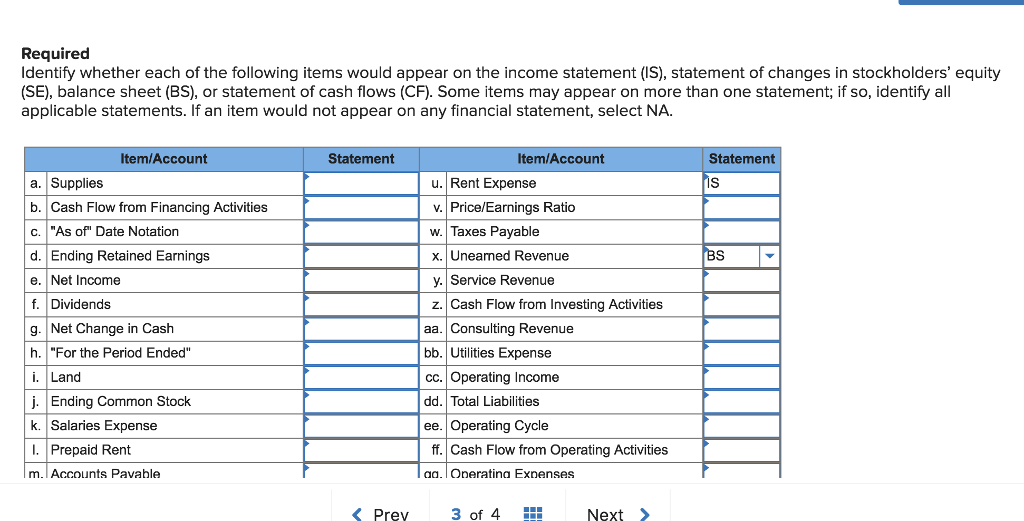

Best Accounting and Bookkeeping Software for Child Care

Procare’s daycare bookkeeping software even allows you to make journal entries for expenses like bank fees or track credit card purchases. On average, child care centers and programs can save up to 12 hours per month in administrative time spent on billing, invoicing and payroll using Procare’s child care accounting software. That is critical time that can be spend on caring for and educating the children in your care. We know that choosing a dog daycare software or a specialized accountant can be tough, but once you’ve gotten started, you’ll see how much easier tracking your business’s financial state can be. No matter what kind of business you run, accounting is integral to ensuring your business is on the right track. Not to mention having the information you need for taxes and other related entities.

- An outsourced bookkeeper ensures accurate record-keeping, timely billing, and payroll processing, reducing the risk of errors and compliance issues.

- Illumine’s child care invoice software enables school owners to configure late fees, which automatically get added to invoices if they are not settled past the due date.

- You might be running into some sort of technical challenge or find a single function confusing.

- If you keep accurate books, you can see whether you’re spending too much money in a particular area such as materials or payroll.

- We make sure that every client is served by the expertise of our whole firm.

- Instead, use it for your day-to-day operations but have an accountant who you can turn to for your needs.

Remote Books Online will enter all transactions, make all necessary journal entries, and reconcile one month of your books for free. We want you to experience and evaluate our bookkeeping service and process for yourself, so we can start to build a long-term relationship with you. You’ll work with a team of experienced Certified QuickBooks Pro Advisors to help you get your books on track. You’ll also have a dedicated, certified lead accountant (with a four-year accounting degree and often more credentials) to answer all of your questions. Every day that we come into work, we take pride in the part we play in helping our neighbors succeed. The communities of the Bay Area recognize the effort we put in for them, and it shows.

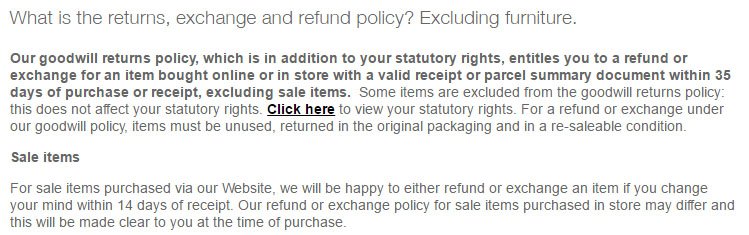

Manage Sponsor Information

If your business is growing—or you’re planning on growing in the near future—hiring an accountant now can save you a lot of stress when it comes time to manage a higher number of transactions. You can get started with a simple daycare invoice template or step it up with automated invoicing software. Creating invoices from scratch can be tedious, but invoicing software allows you to send invoices online, monitor payment status, send automated reminders, and much more. Many business owners make the mistake of using their personal bank account for their business, but this can lead to confusion and costly accounting errors.

When you understand your company’s financial workings, you are better able to keep your operations profitable and stay afloat. If you keep accurate books, you can see whether you’re Daycare accounting spending too much money in a particular area such as materials or payroll. To be as flexible as possible, various child care centers try to accommodate several mediums of payments.

Establish a Bookkeeping System

If you’re looking to audit-proof your business and review your finances, we’re the right choice. You can also contract Better Bookkeepers to handle your bookkeeping on a monthly basis. Alternatively, you might want to get accounting software like QuickBooks operational so you can handle more of the work on your own. Whatever your bookkeeping goals, you can achieve them with Better Bookkeepers. Our team of financial experts, at our Edmonton accounting firm, has extensive knowledge and insights into the operational and managerial issues faced by daycare owners. We will ensure that you avoid pitfalls that can prevent business growth or that may overwhelm you.

To perform bookkeeping for a child care business, follow these steps to ensure accurate financial records and smooth operations. First, set up a dedicated business bank account to separate personal and business finances. Track all expenses, such as supplies, rent, utilities, and payroll for staff. Utilize accounting software like QuickBooks or Xero to manage transactions efficiently.

This website is using a security service to protect itself from online attacks. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data. We work with you to customize bookkeeping solutions based on your specific business needs and budget. Every business is unique, and there’s no single system that’s right for everyone.

Buy Now KidKare Food Program for Your Center

If you are running a business with more than just yourself, you need to keep your employees happy. If the paychecks are not on time or are incorrect, employees become unhappy, and your business and reputation both suffer. This makes payroll one of the most necessary yet most complicated tasks, in the world of business. Our 250 Analysts and SME’s offer a high level of expertise in data collection and governance using industrial techniques to collect and analyze data on more than 25,000 high-impact and niche markets. Our analysts are trained to combine modern data collection techniques, superior research methodology, expertise, and years of collective experience to produce informative and accurate research.

If you’ve opted to integrate cloud software such as Xero or FreshBooks into your business, we can help you pick the right version of software, set it up and even train your staff to operate it. At the heart of any successful business, from the one-person operation to a Fortune 500 company, is a financial accounting system. We also offer insights into strategic and growth analyses and data necessary to achieve corporate goals and critical revenue decisions. If you plan to grow your business, you first need to get your books in order.

That’s why we’re always cognizant of changes to Federal and State tax regulations that could affect businesses in your industry, and we will help you plan accordingly. There are two basic methods in accounting, one is an accrual method, which is more complex and is based on when an expense or a revenue is taken on. So, for example, in the accrual method, the moment you get your credit card bill, that would be something that would be taken off your assets versus when you actually pay the bill.

Thereby freeing up time and resources for you to focus on the children in your care. Whether you are running a day care center out of your home or another place, even if you just go to a client’s home to care for their children, your reputation is your calling card. This is your dream business, but the paperwork and finances are a nightmare.

Bookkeeping services for daycares help daycare centers and parents keep track of their finances. It is a cost-effective way to manage all the financial aspects, including the expenses and income, that come with running a daycare center. One approach to do this is to set up a repetitive instalment plan for families.

Online bookkeeping services can take care of tracking all your financial transactions and provide you with reports to make sure you are not spending money where you could be saving it. These services are very helpful and allow you to have the time to take care of all the other aspects of running a preschool. Quickbooks is by far the most popular accounting software available, serving over 80% of small businesses. With their most recent release of Quickbooks Online, they now provide both installed and web-based options of their software. With many years of experience, they have built a robust product with extensive functionality.

The authors of the report closely analyze all of the leading companies considered for the research study on the basis of different factors such as their main business, gross margin, and markets served. They also take into account their prices, revenue, and production apart from the specification and application of their products. Accounting also tells you when your operations tend to be busiest and when you spend the most money on expenses such as taxes and licenses.